Circle - Making the Web3 Ecosystem Stable

Circle, the company behind USDC, is building the currency, and the platform for the next generation of payment landscape, lets look at its journey to know how the future of payments will look like.

Editor’s Note: Thank you to 34 new people who decided to subscribe to our newsletter, including execs from Robinhood, Plaid, and Tiger Global Management. Term Sheet Digest is a weekly newsletter for the Attack Capital community. If you are in the mood to read about private company stocks that are heating up in the secondary market and the biggest news around Silicon Valley, you are in the right place.

Circle is a Boston-based financial services company that uses blockchain technology for its peer-to-peer payments and cryptocurrency-related products. It was started in 2013 by Jeremy Allaire, who previously founded Brightcove, a video platform company, and Sean Neville.

Jeremy Allaire can easily be called the pioneer of the internet companies, he founded Allaire Corp. in 1994, the company developed Markup Language (CFML) which was used by some of the biggest companies like Target, MySpace, Toys R Us, the company grew from $1 Million in revenue to $120 Million in 2000.

In 2013, Allaire founded Circle a consumer peer-to-peer cryptocurrency payments and exchange platform, the company launched USDC, a stable coin in 2018, one of their most popular product, USDC currently has a market cap of ~$27 Billion.

Volatility and crypto go hand in hand, not just volatility but tremendous volatility, for example, the price of bitcoin rose from under $5000 in May 2020 to over $63,000 in April 2021 and then fell by 50% in the next two months.

If cryptocurrency needs to become the future of payments, it needs to be stable.

If you buy a can of soda for a dollar worth of bitcoins, it needs to hold its value after 2 days, 2 months, or 2 years, $1 dollar worth of bitcoin can’t be worth $100 the next day and 10 Cents the next, because in each case it hurts either the buyer or the seller.

But there is a solution to this problem, called Stablecoins, more precisely fiat-based Stablecoins like USDC (US Dollar Coin) and USDT (known as Tether). These coins are pegged to a fiat currency, say the dollar, whose value remains constant.

Stablecoins are sneakily fascinating because they’re both a digital currency and a sort of platform on top of which new applications can be built or old ones improved.

Stableocoin's most important job is to allow all the benefits of blockchain infrastructure, like transparency, without the cryptocurrency's volatility.

Circle and Stablecoins

Jeremy Allaire is the founder of Circle, a company that started its journey as a consumer peer-to-peer cryptocurrency payments and exchange platform. Circle today is known for launching “the stablest of the Stablecoins” USDC. But, the company took its time coming to stablecoins since its inception in 2013.

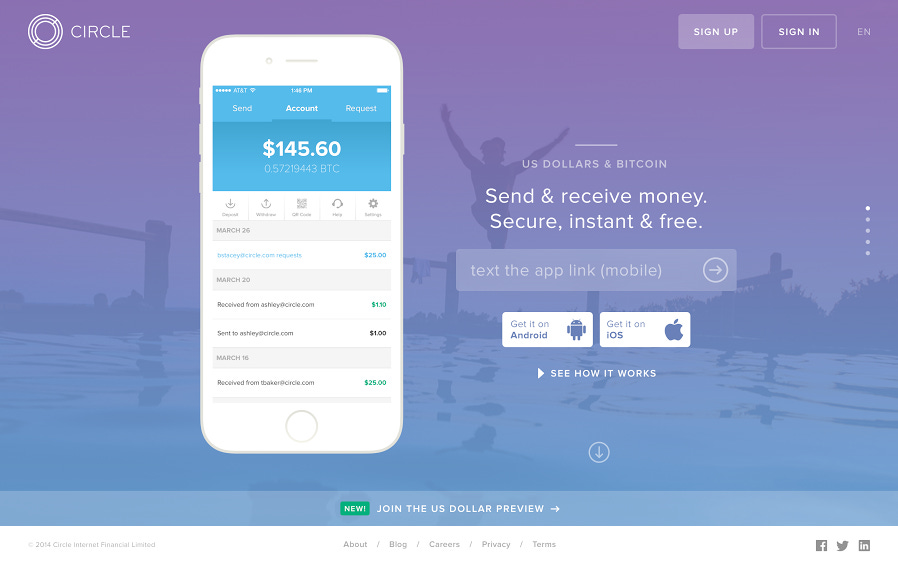

In an interview, Circle’s VP of product, Joao Reginatto, explained the process of his journey from building a consumer app to finally hitting gold with USDC.

The plan was to build a product for people who wanted to transfer funds over blockchain rails with an app that took away the complexity and provided a familiar experience. People are most familiar and comfortable with fiat currency, so they enabled Dollar, Euro, and Pound balances and transfers on Bitcoin’s rails. In the background, they handled all of the liquidity and treasury operations, like converting dollars into BTC and back.

But by 2016, it was getting too slow to operate on Bitcoin, which was built to be P2P money, not to support apps on top. They tried ETH, and it wasn’t quite right, either. Then, they thought about launching their own settlement token. No go. Finally, they realized that what they needed was fiat currencies that run on blockchains.

They looked into Tether but didn’t think they could build on top of it, so the team realized they’d need to create their own stablecoin. They brought it to the leadership team, who said, “OK! Go build a stablecoin if you don’t have the rails you need, and then we can come back to Circle Pay.”

“Then,” Joao laughed, “We never came back.”

USDC was finally launched in September 2018.

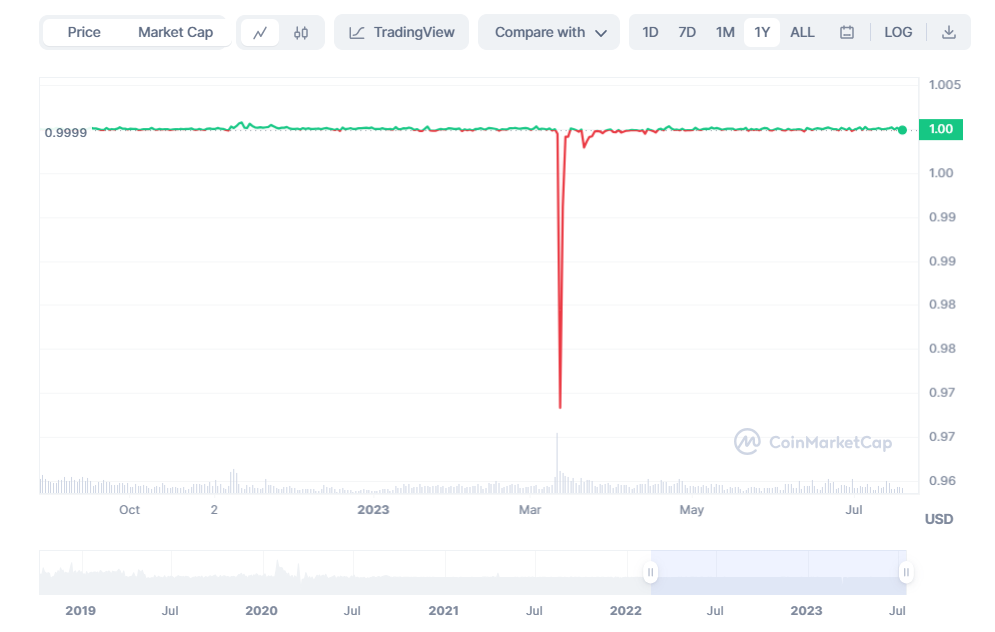

*The fall in prices in the USDC value represented by the red line is due to Terra-Luna crash.

Amazingly, the company raised $246 Million even before landing on and announcing what would become its biggest hit: USDC.

With Jeremy’s background and the early excitement around Bitcoin, he had no trouble raising money. Per PitchBook:

2013: $9 million Series A from Breyer Capital, Accel, and General Catalyst

2014: $17 million Series B led by the same investors with Pantera Capital

2015: $50 million Series C led by Goldman Sachs & IDG Capital at a $250M valuation

2016: $60 million Series D led by IDG Capital at a $480 million valuation

2018: $110 million Series E led by Bitmain at a $3 billion valuation

The Founder

Circle isn’t Jeremy Allaire’s first rodeo. In 1994 when the internet was just getting started, he founded Allaire Corporation. The company built a markup language Cold Fusion which was used by companies like MySpace, Target, and Toys R Us, along with millions of other websites to build their online properties.

In 2000, Allaire Corp. was bringing in $120 Million in revenue and had offices around North America, Asia, Australia, and Europe. Allaire Corporation IPOed in January 1999 and was acquired by Macromedia in March 2001 for $360 Million. As a result of this acquisition, Jeremy Allaire became CTO of Macromedia. Due to some differences in product strategy, Allaire left the company and found himself at General Catalyst as a technologist and executive-in-residence.

At General Catalyst, Allaire incubated Brightcove, which is now a NASDAQ-listed technology provider to streaming companies. While building Brightcove, Jeremy hired his friend from Macromedia, Sean Neville, as his Senior Software Architect. Although Neville left the company after some time to start up on his own, but the pair kept in touch. Sean Neville would later come back to work with Allaire as his co-founder on a company that most people thought was a crazy bet for an experienced entrepreneur - Circle.

The many Iterations of Circle

Circle started as a consumer peer-to-peer cryptocurrency payments and exchange platform, sponsoring the popular cryptocurrency exchange Poloniex, which was later spun out in October 2019.

The company's first product was an app called Circle Pay. The app was a Bitcoin trading exchange. In September 2015, Circle Pay was granted a BitLicense, New York state's license for operating Bitcoin exchanges.

In 2016 the company stopped offering its cryptocurrency wallet services. In June 2019, it was announced that Circle Pay mobile and related web apps would be discontinued.

Circle is a case study in compromise, it is building something for everyone. It’s a centralized company facilitating the growth of a decentralized financial system. It’s used by web2, web3, and web2.5 companies alike. It’s happy to sit in the background, facilitating fast, cheap, global payments and loans while others build shiny interfaces and sturdy guardrails on top.

Its Day 1 for Regulations and Compliances

In an interview, Jeremy put it bluntly: “The reality was, if you wanted to build a business at the intersection of the traditional and new systems, you had to be regulated or go to jail.” “We got every license we possibly could and became the most licensed and regulated firm in crypto at the time.”

Jeremy’s first hire was one of the country’s top regulatory advisory firms out of his own pocket, and they found that while there wasn’t a lot of precedent or guidance, there was something to work with. In March 2013, the US Department of Treasury issued a six-page memo titled “Application of FinCEN’s Regulations to Persons Administering, Exchanging, or Using Virtual Currencies.” Essentially, it said that if you act as an exchanger of money from the banking system to digital currency, you must register as a money transmitter, have Anti-Money Laundering (AML) and Anti-Terrorism policies in place, and get all the appropriate licenses - something which Circle did.

Earlier, there were questions about the government's role and pace in regulating crypto and, more importantly, stablecoins in Circle’s case. After the Terra-Luna crash, which took crypto hedge fund Three Arrows Capital (“3AC”), which then contributed to the downfall of Celsius, BlockFi, Voyager, and other Centralized Finance (“CeFi”) lenders. Governments have picked up their pace when it comes to crafting regulations for stablecoins, especially the ones backed by fiat currency.

Terra-Luna Fiasco

No one can explain the insanity behind Terra-Luna Fiasco better than Money Stuff’s Matt Levine, so I’ll turn it over to him for this section.

Here is how an algorithmic stablecoin works:

You wake up one morning and invent two crypto tokens.

One of them is the stablecoin, which I will call “Terra,” for reasons that will become apparent.

The other one is not the stablecoin. I will call it “Luna.”

To be clear, they are both just things you made up, just numbers on a ledger. (Probably the ledger is maintained on a decentralized blockchain, though in theory you could do this on your computer in Excel.)

You try to find people to buy them.

Luna will trade at some price determined by supply and demand. If you make it up on your computer and keep the list in Excel and smirk when you tell people about this, that price will be zero, and none of this will work.

But if you do a good job of marketing Luna, that price will not be zero. If the price is not zero then you’re in business.

You promise that people can always exchange one Terra for $1 worth of Luna. If Luna trades at $0.10, then one Terra will get you 10 Luna. If Luna trades at $20, then one Terra will get you 0.05 Luna. Doesn’t matter. The price of Luna is arbitrary, but one Terra always gets you $1 worth of Luna. (And vice versa: People can always exchange $1 worth of Luna for one Terra.)

You set up an automated smart contract — the “algorithm” in “algorithmic stablecoin” — to let people exchange their Terras for Lunas and Lunas for Terras.

Terra should trade at $1. If it trades above $1, people — arbitrageurs — can buy $1 worth of Luna for $1 and exchange them for one Terra worth more than a dollar, for an instant profit. If it trades below $1, people can buy one Terra for less than a dollar and exchange it for $1 worth of Luna, for an instant profit. These arbitrage trades push the price of Terra back to $1 if it ever goes higher or lower.

The price of Luna will fluctuate. Over time, as trust in this ecosystem grows, it will probably mostly go up. But that is not essential to the stablecoin concept. As long as Luna robustly has a non-zero value, you can exchange one Terra for some quantity of Luna that is worth $1, which means Terra should be worth $1, which means that its value should be stable.

“All of this is,” Levine writes, “quite straightforward and correct, except for Point 7, which is insane.” $UST and $LUNA rose in tandem, and they fell in tandem.

Trust in crypto infrastructure and stablecoins hit its lowest point because of the Terra-Luna ordeal.

Big Names = Big Trust

Circle realized that if it needs to bridge the gap between web2 and web3 and build a modern financial system where cryptocurrency and fiat can co-exist, it needs to do more than just build USDC.

It needed to build trust, and it did by building partnerships with big names in payments.

Circle started championing current payments incumbents to accept USDC, and Visa was one of the biggest companies to come on board. Visa was planning to let their customers settle transactions using USDC on their partner wallet, and who best to partner with than the makers of USDC?

Circle also announced Circle-Visa Corporate Card for Circle bank account holders, using which they can transact with 60 Million merchants that are onboard with Visa.

Moneygram, Mastercard, Worldpay, and Coinbase soon followed suit. After leading Circle’s funding round, Blackrock became Circle’s primary asset manager of USDC cash reserves—the fiat currency backing the Circle-issued USDC stablecoin. BNY Mellon was also selected as a primary custodian for USD Coin (USDC) reserves.

These big names provided the confidence necessary for the Circle team to truly build a global financial network where web2 and web3 guard rails can coexist.

Web 2 and Web 3 big names partnership solves another big problem, many of the most popular apps – like Uber and Airbnb – have wallets built-in.

Currently, those companies need to register in multiple jurisdictions and set up different banks based on where they operate. Airbnb, for example, is an e-money company in Europe and needs to hold and maintain a license to hold customer balances. Building with something like a Circle wallet, they might be able to let users self-custody, top up their accounts, and spend frictionlessly with much less headache for both Uber & Airbnb, and for users.

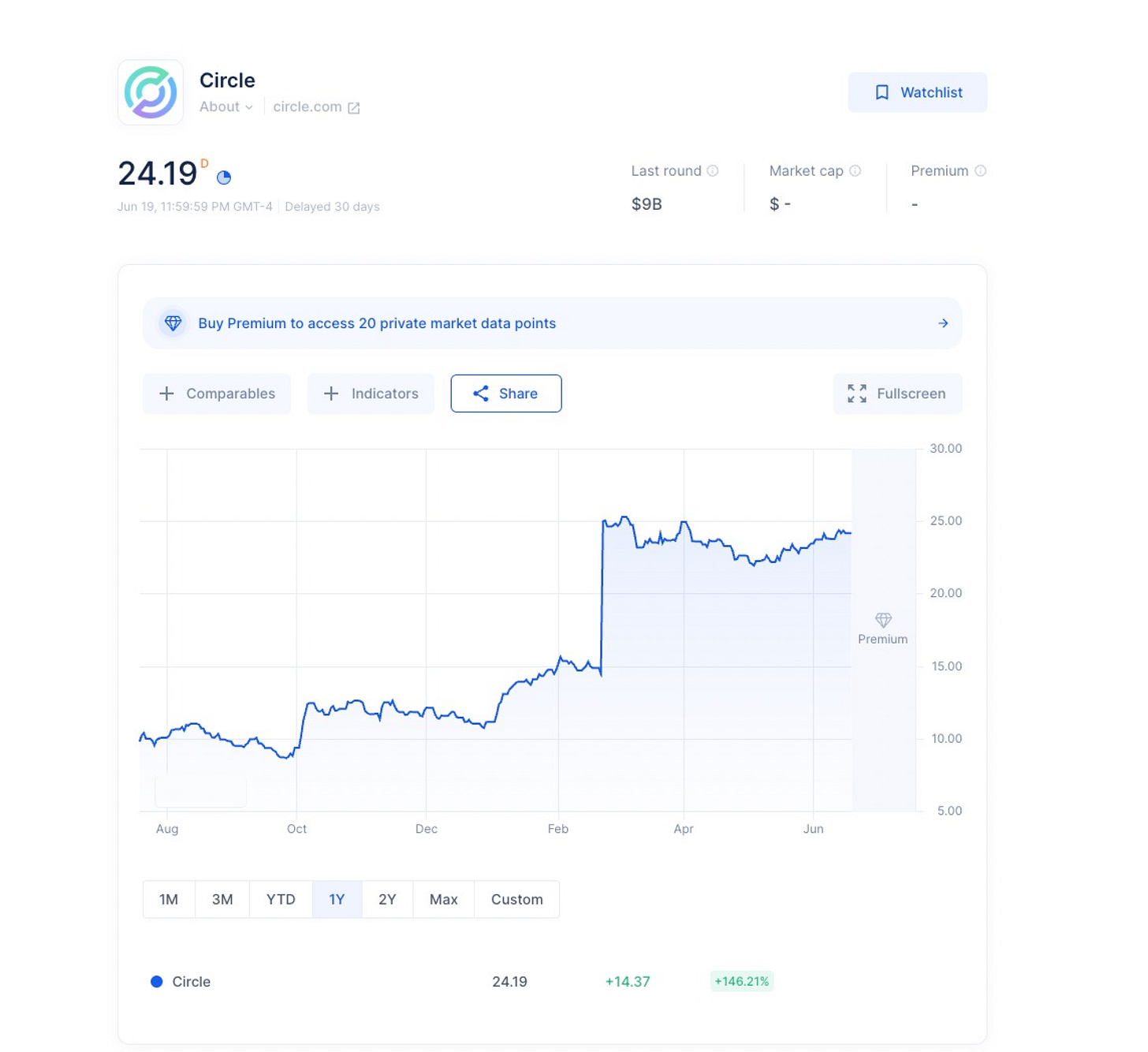

Secondary Market Outlook

Circle’s biggest brand is its founder, Jeremy Allaire, crypto gets a bad rep, but when you see an entrepreneur who started their first internet venture in 1994 when the internet was seen as a fad and successfully led that company to an IPO, building a crypto company, you start to think twice.

An entrepreneur who grew his first company to $120 Million in revenue, he created a web development language used by companies like Target and MySpace. Not only this, his second company was publicly listed and was valued at $290Mn during its IPO. It is highly likely that the person who has been right twice has a pretty good sense of judgment and has a better chance of being right the third time.

If that is not enough, Circle's partnership with the big guys in the payments space - VISA, Mastercard, raising millions of dollars from the biggest investors like Accel, General Catalyst, Blackrock, and Fidelity, and licenses from all the necessary regulators is enough to provide secondary investors the assurance they need that their investment is bound to grow in the coming years.

Although it took its time landing on building USDC, Circle did one thing right from the beginning: building relationships with regulators. The biggest competitive advantage for Circle is not its product, tech, and innovative financial infrastructure, it’s the relations it built with regulators and how each product it launched and each partnership it built with Visa or Blackrock has complete regulatory approval.

Some people question the need for another financial infrastructure, but there have always been problems to solve since the beginning of time, and old ways have made way for new ways of doing things. Similarly, in the payments space, so much has changed even in the last 10-20 years, and still, a lot of problems are left to be solved. Circle’s partnerships with the big wigs of the Web 2 economy, like Visa, are a testament to the need for their product, and in the next 10 years, the need will be more and more visible.

Top Stories

Michael Moritz, the journalist-turned-VC who has long been one of the most prominent and respected investors at Sequoia Capital, has left the firm after 38 years to “deepen his advisory relationship” with Sequoia Heritage, the wealth management unit he spun up in 2010 with colleague Doug Leone and on whose board he has sat for years.

The U.K.’s competition authority has approved Broadcom’s $69 billion bid for virtualization software giant VMware. The news comes exactly a week after the European Commission (EC) approved the deal, which pretty much leaves the U.S. as the last remaining hurdle for Broadcom.

Dunzo, a hyperlocal delivery startup in India, is postponing employee salaries for a month and intends to settle remaining dues from the previous month also in September as the Google and Reliance Retail-backed startup hunts for new funding.

“Thought Leadership”

Well, crypto is back after the Ripple judgment, here’s an interesting thread on the judgment and what it means for the broader ecosystem.

Please share this newsletter with your friends, family, and colleagues if you feel that it’ll add value to their lives - probably the best compliment we can get :)