Introducing Attack Capital: Bringing private markets to the public

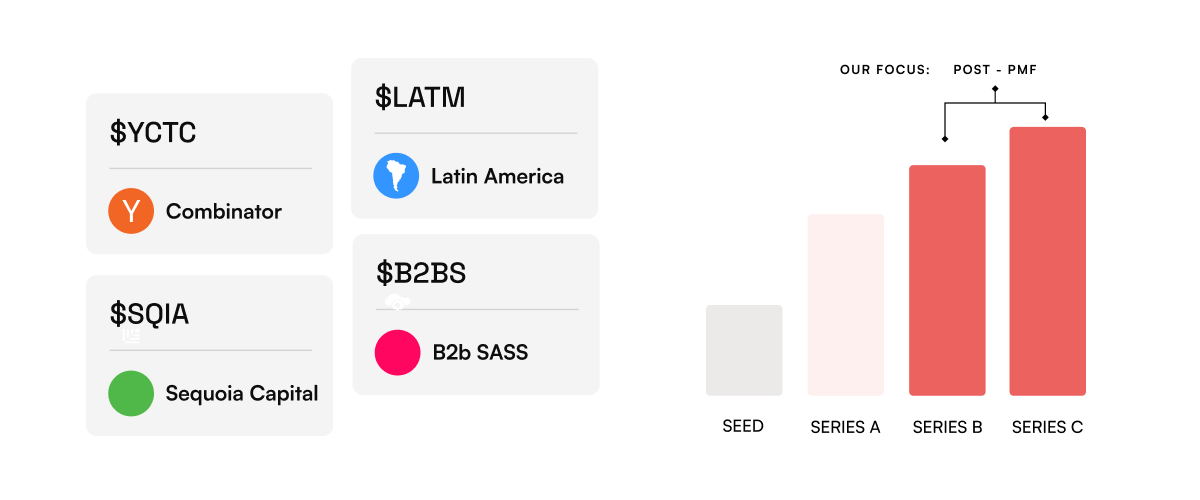

I am excited to announce the launch of Attack Capital—the public ticker for private companies. Attack capital will enable you to index the fastest-growing private companies before they go public. Think S&P 500 or NASDAQ 100, but focus on private YC companies.

Our flagship ticker, YCTC, will be a closed-end exchange-traded fund with companies like Stripe, Brex, Deel, Instacart, and others.

Valued at > $150 million and listed among YC’s list of top companies

Provide diversified access across industry and region to the best high-growth technology startups.

📌 Private Markets - Engine of Wealth Creation

Private markets have been a powerful force of wealth generation for the past decade. Unicorns account for a total market capitalization of $3.7 trillion and growing.

However, access to private companies as an asset class has been gated by net worth 💰 and network 🔗.

Venture capital, Secondaries, and Late-stage private equity are only open to individuals with a net worth of $50M or above, and even then, access to these deals depends on who you know. Outside of the rarefied confines of Silicon Valley & Wall Street board rooms, the majority of us are denied access to this burgeoning and high-growth asset class.

While the impact of technology has touched every individual, why does wealth creation be reserved for a select few? We think this is wrong.

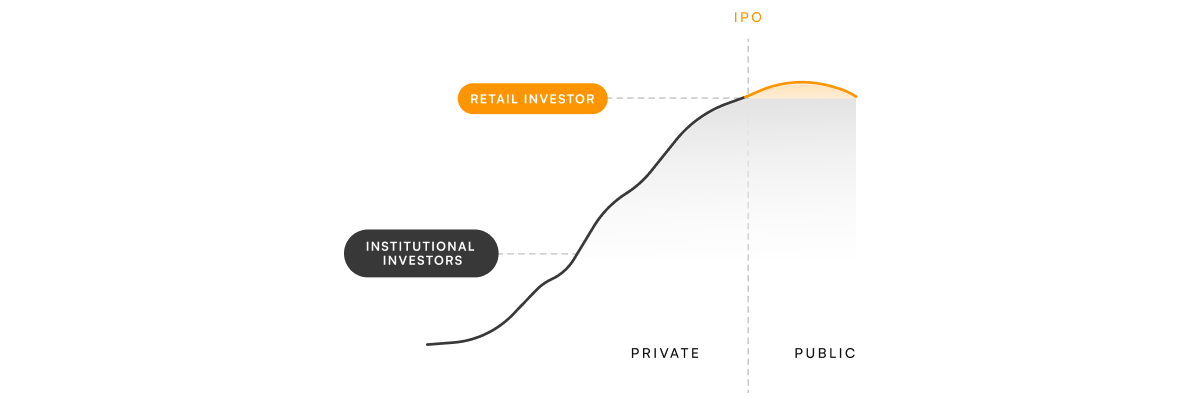

📌 Value Creation in Public vs Private Markets

In the past, the best companies IPO’ed in 5-6 years from inception. Retail investors had the option to join early and become a part of a company’s growth story. For eg., Amazon went public three years after it was founded at a valuation of $435 million in 1999 compared to its market cap of $1.88 trillion in July 2021. That’s a 4292x return 🚀.

But when Uber went public. It made history – for the the largest first-day IPO loss of all time. On May 9, 2019, a single share of Uber cost $45. The next day it was down to $42. Barely three years after their IPO, Uber traded at less than $22 per share.

What seemed like a great opportunity to invest in a huge company turned out to be a case of getting on the elevator on the top floor.

So what happened?

Uber was an early example of the impact staying private for long can have on IPOs. By the time they opened the doors to let the public in, the exponential growth phase had already come and gone. While early investors had enjoyed significant earnings, public investors were largely left with losses.

📌 Our mission is to index the private market for retail investors.

We will create a family of exchange-traded funds that, once publicly listed, will enable anyone with a brokerage account to invest in portfolios of private companies — by industry, location, and institutional backer.

Focus on category leaders:

We will create a family of exchange-traded funds that, once publicly listed, will enable anyone with a brokerage account to invest in portfolios of private companies — by industry, location, and institutional backer.

Index top institutions, markets & industries

Our portfolios will be designed around private investments of top venture capital firms by emerging technologies and markets.

Find this interesting? Invest in Top YC Companies with us