Pay as You Go: The Rise of Usage-Based Pricing in SaaS

Traditional subscription model in SaaS is going through a massive upheaval as companies are determined to make every dollar count in the time of uncertainty, but what will replace it?

TLDR; If you only have a couple of minutes

Usage-based pricing (UBP) is an effective pricing model that helps companies limit expense risks, monetize customer growth, and reduce churn. It offers transparency, continuous growth at scale, and better retention rates compared to traditional subscription models.

Challenges in defining users, especially with automation and AI reducing, and the increasing value derived from API interactions, complicate user-based pricing and support the shift toward UBP.

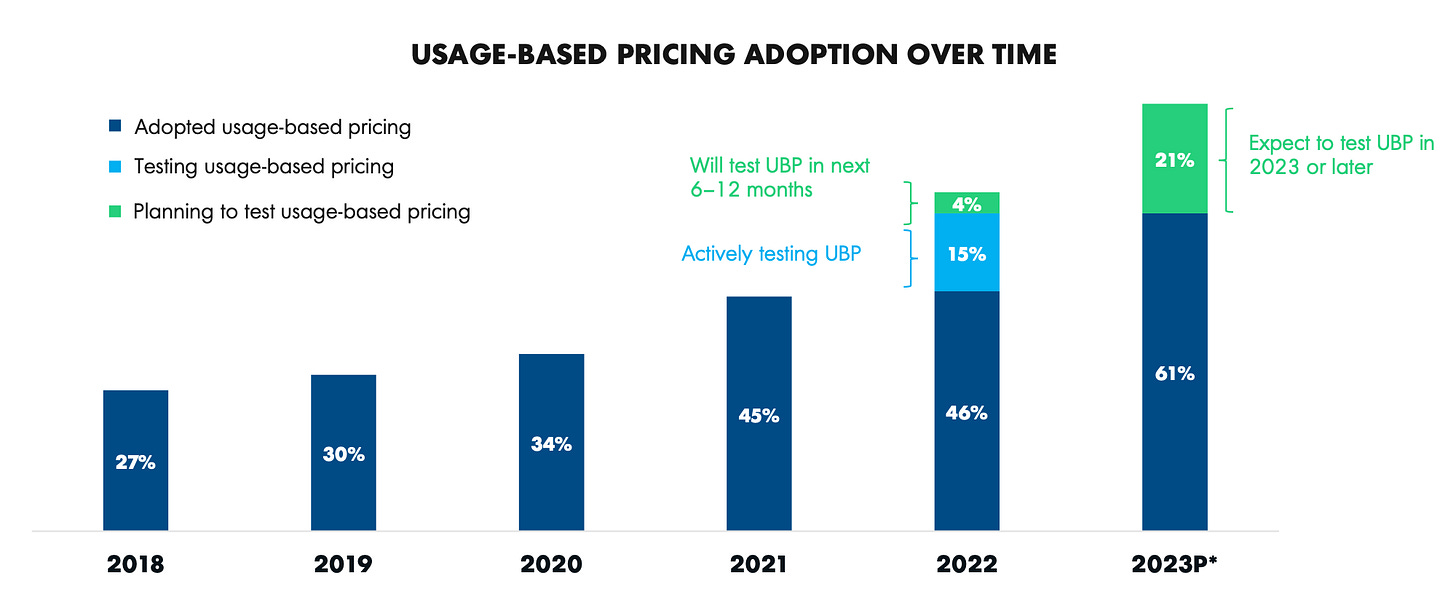

SaaS companies are transitioning away from traditional per-seat or subscription pricing models. According to Openview Venture Partners, 61% of the general SaaS index will adopt UBP by year-end.

Hybrid pricing, which combines subscription and usage-based pricing, currently dominates the pricing landscape because companies that were previously fully subscription-based need some time to introduce UBP.

When Segment (YC S11), a customer data management platform, wanted to convert its first couple of free customers to paying customers, Peter Reinhardt, the co-founder and former CEO, decided to send an email to their customers asking them to pay $120 a year for their product.

One of the customers replied, “Guys, this price is so low that I may have to stop using your product because there is no way you're going to be around in a year. You better raise your price.”

Peter immediately decided to consult a sales advisor, who told him to ask for $120,000. After a little negotiation with their customers, they settled on $18,000 annually, a staggering 150X from the initial $120 price suggested by Peter.

B2B pricing is as complex as it gets. In B2B sales, value is what matters to the customer, and that is what companies should sell on. To align your product value with the customer’s value, start by pricing based on usage-instance instead of asking them to commit to an annual subscription plan. This also reduces entry barriers and increases the potential for adoption.

USAGE NOT USERS

Another thing that makes pricing more tricky is defining users. If you start pricing by seats i.e number of people using the product, you hit a roadblock when you realize software increasingly automates manual processes. The more successful a product is, the fewer user seats a customer needs.

AI takes automation a step further, eventually eliminating the need for whole teams of people for ongoing tasks. It gets even more complex when you realize that sometimes most of the software value comes from software talking to each other - API rather than the UI. The only solution is to price your customers on the usage of your product rather than the number of users using your product.

THE BEST OF BOTH WORLDS

It is clear that SaaS companies need to move beyond the old per-seat or subscription pricing paradigm. Now, If you have a small company with just a couple of customers, it's easier to switch pricing models and convince your customers to stay. But for large enterprises with thousands of customers and millions in revenue, if not navigated well, it is disastrous to ask your customers to switch to a new pricing model completely.

Companies also need to worry about getting new customers, will they accept usage-based models and stick to what they know - subscriptions or per seat?

Between keeping the old customers happy and signing up new customers, SaaS companies are trying to meet their customers where they are by offering hybrid pricing - some part subscription and some part usage-based.

Usage-based pricing works when companies want to limit expense risks on new SaaS purchases by tying product value directly to business usage value.

Vendors can introduce usage-based prices to support businesses to scale feature usage when required - unused products don’t get billed. UBP also helps SaaS vendors monetize usage in proportion to their customers' growth, and it also limits churn by decreasing payment load on non-utilization.

According to a report by Openview Venture Partners, three out of four companies have some form of usage-based pricing model, and share will continue to grow as more and more companies realize its importance. Openview also has a prediction that by the end of this year, 61% of the general SaaS index will have adopted some form of usage-based pricing, with another 21% planning on testing UBP in the future.

While the usage-based is the new kid on the block, the hybrid model is the one that currently dominates the playing field. According to our friends at Openview, 15% of SaaS companies have rolled out a largely usage-based or pay-as-you-go model, and three times as many companies (46%) take a hybrid approach either by testing UBP alongside traditional subscriptions or offering a usage-based subscription plan. For example, HubSpot offers hybrid usage-based pricing via a set volume of usage in its subscription options. Customers can buy more users as they grow.

The goal for SaaS companies as well as companies in some other sectors, is to move to a largely usage-based model because of the transparency it brings for both customers and vendors. After all, Usage-based businesses also see continuous growth at scale and best-in-class retention rates compared to their peers who are still stuck in the subscription models.

CATEGORY CREATION - THE PRICING STACK

It is abundantly clear that SaaS companies are stretched thin while trying to price their products, and with so much uncertainty regarding the macro as well as the technological landscape, it will get even harder to price products.

What happens when a large sector of companies struggles with a common problem - a new category of companies comes in to solve the problem. To solve the pricing problem, a whole new set of SaaS products are coming in to help companies offer complex pricing - The Pricing Stack. Enabling everything from metering and billing to pricing optimization, ultimately creating entirely new categories in the SaaS landscape.

The next most important as well as interesting thing to see in the SaaS landscape is the role AI will play in not just building better SaaS products but pricing them as well. Will the additional AI-supported features make the pricing more complex, or the pricing stack will use AI to make the pricing much more streamlined, or both?

Quoted Sources: