Revolut- Europe's $20Bn Neo-Banking Giant

Started as a prepaid card for cross border payments, the startup quickly grew into a neo-bank for individuals and businesses. Let's take a behind the scenes peak into UK's most valued startup.

Editor’s Note: Thank you to 62 new people who decided to subscribe to our newsletter, including execs from Razorpay, Cohere, and JP Morgan Chase & Co. Term Sheet Digest is a weekly newsletter for the Attack Capital community. If you are in the mood to read about private company stocks that are heating up in the secondary market and the biggest news around Silicon Valley, you are in the right place.

Revolut is a neo-banking company, started by Nikolay Storonsky and Vlad Yatsenko, both the founders come from an Investment Banking background.

The company was started in 2016, as a prepaid card startup for cross-border payments to combat high exchange fees and poor exchange rates that traditional banks charge.

Revolut has raised $1.7Bn in total funding from investors including DST Global, Ribbit Capital, Tiger Global, Softbank, and it is valued at $20Bn.

Revolut is the United Kingdom’s most valued startup at a $20Bn valuation.

Nikolay Storonsky spent the early years of his career as an equity derivatives trader at Lehman Brothers and then at Deutsche Bank. He was travelling across Europe when faced issues with high exchange fees and poor exchange rates that traditional banks charge.

Vlad Yatsenko also worked across Investment Banks like Credit Suisse and Deutsche as a developer. Nikolay, although had a great idea and financial background, needed a developer to build on his ideas, and luckily he met Vlad.

Together, they started working on what is now Revolut’s most successful product - a prepaid debit card that would enable users to spend multiple currencies at the interbank exchange rate.

Due to the success of Revolut’s prepaid card, the company gained over 100K personal banking users in just its first year.

A Card Company to a Neo-Bank

Revolut was already the go-to solution for prepaid cards if you wanted to avoid high exchange fees and poor exchange rates while traveling across borders.

But you don’t become the UK’s most valued startup by offering prepaid cards and taking 0.5-1% transaction fees. Revolut wanted to go bigger.

The co-founders, while digitizing the pre-paid card space, saw the challenges that most consumers face while dealing with the age-old technology of traditional banks. They decided to digitize the entire banking space.

Today, Revolut offers personal & business banking products. Their products, for ease of understanding, can be divided into (i) Essentials, (ii) Investing, and (iii) Lifestyle Management, as suggested by our friends at Contrary.

Revolut’s Consumer Banking Stack

As part of Essential consumer banking services, Revolut allows users spread over 200 countries to transfer money, make payments, and split bills. It also offers a currency converter, enabling users to purchase and hold up to 29 fiat currencies and over 100 crypto tokens. A couple of additional services that Revolut offers as part of the Essentials package:

Early Salary enables users to request and receive their salary a day earlier without fees.

Rewards provide users with discounts and cashback at selected stores.

Saving Vaults allow users to earn up to 3% AER/Gross (variable) paid daily.

Open Banking provides a dashboard for users to view bank accounts from multiple providers in a single interface within the Revolut app.

Subscription Management enables users to oversee subscriptions, receive trial notifications, and block subscription charges.

As a part of Revolut Investment offerings, its users can trade stocks, cryptocurrencies, and even rare metals - gold, silver, etc. Users can start investing in over 1.5K global stocks commission-free, starting with $1. Additionally, Revolut provides educational materials and courses to educate users on investing in stocks and cryptocurrencies.

Revolut’s Lifestyle services take the company to the reason for its existence. users can book holiday accommodations within the platform, earning up to 10% cash back on purchases. While traveling, customers can access over 1K airport lounges for additional costs. Further, customers can spend money at real exchange rates in 29 currencies while traveling without hidden fees. Additionally, Revolut offers pet insurance and 24/7 vet access via video call for additional costs.

Revolut’s Business Banking Stack

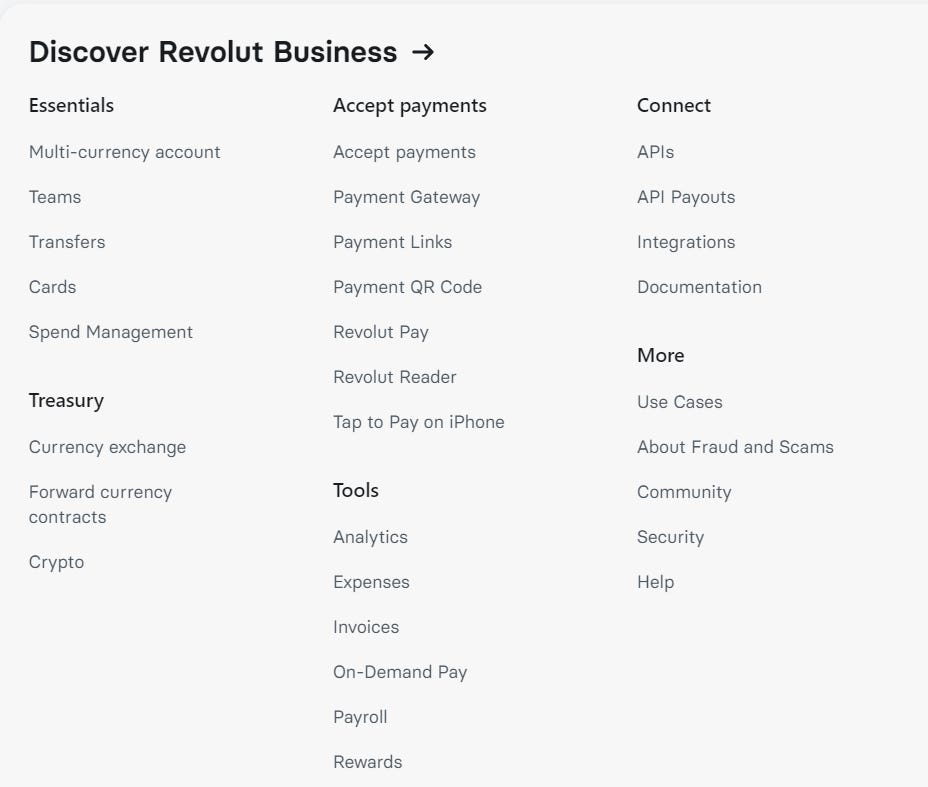

Revolut’s business banking services allow businesses to send money globally and set up multi-currency accounts in over 25 currencies. Employers can also invite employees and manage spending in real-time - just like Ramp’s corporate card offerings.

Spend Management enables businesses to automate their bookkeeping process by integrating with Xero, QuickBooks, or Sage. Employers can also issue physical and virtual cards and can control spending by setting limits, freezing cards, and automatically reminding staff to submit expense receipts - again, like Ramp’s corporate card offering.

Revolut also allows businesses to accept payments in multiple currencies through Revolut’s payment gateway API, payment links, QR codes, Revolut Reader (the company’s point-of-sale card reader), and Revolut Pay. Revolut also acquired Nobly POS, an ePOS company, to expand into online and offline payment processing for the hospitality sector - it is integrated with Revolut Reader.

The final offering that makes Revolut one of the best digital-first business banking companies is its API offerings. Clients to access their API, customize their online payment experience, or automate payouts. Users can also integrate the Revolut API to automate payments to suppliers and other service providers, create requests to access data from their account, view all transactions and generate reports, use webhooks to receive instant updates, and request user data with OAuth.

Revolut’s Competition

Neo-banking in the UK and Europe is a crowded space - Monzo, N26, and Starlink Bank are also present in the same market. But the direct comparison isn’t so simple. While Monzo positions itself as the everyday bank for everyone, Starling focuses on B2B banking and selling BaaS to fintech, and Revolut and N26 have focused on geographic expansion.

As of June 2023, Revolut reported having over 30 million personal users and over 500K business users, with over 10K new businesses joining monthly and over 130K business cards issued monthly. The company has generated about $1 billion in revenue or £850M in 2022; its gross margin has also improved from 33% to 70% from 2020 to 2021.

In terms of the number of customers for personal banking, Revolut with 30Mn dwarfs Monzo’s ~7Mn, and N26’s ~8Mn. For Business Banking customers, Starlink takes the cake of 2Mn customers compared to Revolut’s 500K.

On the other hand, Monzo also made a profit in January and February this year; annual losses came in at £116.3m – a small decrease on the net loss of £119m reported in 2022. It is targeting full-year profitability by the end of 2024.

Revolut in Secondary Markets

Revolut raised its last primary round of funding in July 2021 - a $800Mn Series E round from Lakestar, Tiger Global, & Softbank. Since then, the company has sold a couple of its shares in the secondary market, but only to big institutional investors. The company also trimmed its valuation by 40% since its Series E, which brought down its valuation from $33Bn to $20Bn - still the UK’s highest-valued private startup.

The valuation cut was at terms with its peers in the US - Stripe, United States’ most valued private company whose valuation was brought down from $95Bn to $50Bn due to the slowdown in the market.

A couple of available shares of the company have gone from ~$340 a piece to ~$230 a piece since the downturn last year. But Revolut is a well-capitalized company that has expanded globally and created a stellar portfolio of products. Revolut also has options to monetize their products from both sides, consumers as well as businesses.

The company operates in a space that is hard to break into due to multiple regulations. Although there is no clear timeline for when the company will go public in the next 2 years, we can expect the company to sign its IPO papers.

Top Stories

Institutional crypto adoption in Asia is growing as the US market remains a question mark, South Korea, Hong Kong, Japan, and Singapore are all looking for more opportunities in the space, thanks to more regulatory clarity in the region.

Amazon announced an expansion of its logistics network that will allow its selling partners to move their products in bulk from Amazon’s low-cost storage service, Amazon Warehousing Distribution (AWD), to any sales channel, including physical stores and warehouses, instead of only directly to consumers’ doorsteps.

Salesforce announced Einstein Copilot Studio, a tool that lets customers customize the Salesforce base Einstein GPT and Einstein Copilot offerings.

Einstein Copilot Studio consists of three elements: prompt builder, skills builder, and model builder, according to Clara Shih, CEO of Salesforce AI.

Please share this newsletter with your friends, family, and colleagues if you feel that it’ll add value to their lives - probably the best compliment we can get :)