Rippling - Parker Conrad's $11Bn Spite Store

Parker Conrad built Zenefits into a $4.5Bn giant, after which he was ousted as its CEO, so he built a $11Bn spite store in the form of Rippling as his next act.

Editor’s Note: Term Sheet Digest is a weekly newsletter for the Attack Capital community. If you are in the mood to read about private company stocks that are heating up in the secondary market and the biggest news around Silicon Valley, you are in the right place.

This Week’s Top Pick in the Secondary Markets

Rippling is a cloud-based HR tech company that offers a comprehensive platform for managing various human resources functions, such as employee onboarding, payroll processing, benefits administration, and time and attendance tracking.

Founded in 2016, by Parker Conrad and Prasanna Sankar, the company has established itself as a leader in the HR software space by providing a user-friendly and integrated solution that streamlines HR processes and increases efficiency.

Parker was the former founder and CEO of Zenefits, a HR-tech software company that grew to a $4.5bn valuation within 3 years of founding. Zenefits grew too quickly which led to a series of errors and non-compliance - ultimately leading to Parker’s exit from the company.

Currently valued at $11.25Bn, Rippling’s product, at its core, is middleware – a trove of applications built on top of an employee data system of record.Rippling starts with the atomic unit – the employee and all associated context (position, clearance, salary, etc.) and is able to build more effective connective tissue across departments of the end customer.

Term Sheet Analysis

A quick look at Rippling’s Revenue

Rippling’s revenue consists of high-margin subscription fees from HR and IT SaaS, low-margin insurance and benefits revenue, and management fees for Professional Employer Organization (PEO) services.

Rippling makes most of its money from subscriptions, with the revenue from insurance and benefits less than 10% of its topline. Rippling’s basic SaaS package is a $35 monthly fee plus $8 per employee per month and includes a workforce management platform, employee onboarding and offboarding, payroll, time tracking, and integrations. Other components like benefits and IT SaaS are sold as modular bolt-ons.

The numbers for Rippling are better than expected, especially during the current drawdown; the company ended 1Q ARR with $180mm, its current ARR (May 2023) is at $200mm, and YoY Top Line Growth is at 2x.

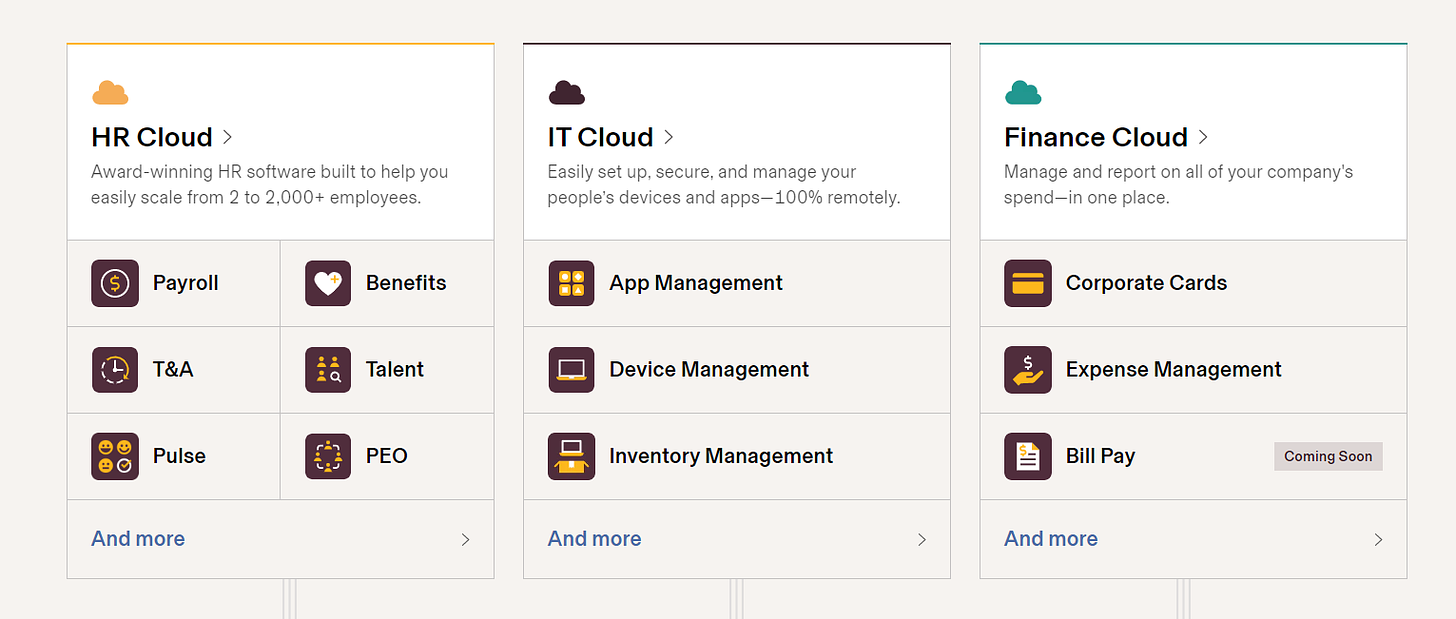

The Platform

Rippling’s flagship workforce management platform covers pretty much all aspects of businesses. Rippling’s Workforce Management Platform takes care of the Employee system of record, workflow management across finance, HR, and IT, analytics on employees, and policy management. Plus, it has additional features like HR Cloud, IT Cloud as well as Finance Cloud.

Secondary Market Performance

In the last two years, Rippling raised a couple of growth rounds - Series C & D from some of the biggest names in VC, which led to its demand and share prices soaring in the secondary markets. First, from just $6 to $26 per share after its Series C round and then to $43 per share after its Series D round in May 2022.

Currently, its shares are available at a 45% discount from the last round, which was priced at $43 a share in both primary and secondary markets; it was a $500Mn round by Greenoaks Capital Partners, which was needed to clean up the damage done by the collapse of SVB.

IPO Bells are Ringing

Parker has communicated internally that the Greenoaks round would be the last round of financing before liquidity. We underwrite Rippling to a base case IPO scenario in 2025. Napkin sensitivity at 10% IPO dilution, assuming they end the year at $300m of ARR models between 1.4x - 2.4x gross MOIC.

Rippling is competing with Gusto, and Deel, companies backed by almost the same investors as Rippling. But, Rippling’s global presence could turn out to be its saving grace in its fight with Gusto and Deel. As soon as the IPO window opens up, Rippling could be the first few companies to test out the waters, and with Parker Conrad’s intensity and the backing of some of the biggest VCs in the world, Rippling could easily deliver on its promise and potential.

Top Stories

Sequoia plans to split into three entities — Sequoia Capital in the U.S. and Europe, Peak XV Partners in India and Southeast Asia, and HongShan in China.

U.S. Securities and Exchange Commission (SEC) sued Coinbase, the largest domestic cryptocurrency exchange, for securities law violations. The suit comes just one day after the SEC sued Binance, the largest crypto exchange in the world by volume, also over securities matters.

India’s EdTech giant Byju defaults on $1.2Bn loan repayment and filed a complaint in the New York Supreme Court to challenge the acceleration of the $1.2 billion term loan B, calling their demands for prepayment of the entire amount “high-handed.

“Thought Leadership”

Sama is in India preaching AI; India comes second to the US in terms of ChatGPT users.

Last Week in Numbers

$3499: The price of Apple Vision Pro, at WWDC 2023, Apple finally revealed Vision Pro. The new headset runs visionOS, uses two Apple Silicon chips (M2 Ultra and R1), and can be used for up to two hours with a tethered battery pack or for as long as you want if it’s plugged in.

$100Mn: As the AI sector heats up even more, there are at least 36 Generative AI companies that have raised more than $100Mn in the last couple of months.

Please share this newsletter with your friends, family, and colleagues if you feel that it’ll add value to their lives - probably the best compliment we can get :)