Databricks' Rise in the Secondary Markets

Your weekly read about the ripples and waves in the secondary markets and some loud chatter around the valley.

Editor’s Note: Welcome to our 198 new subscribers who decided to join the Attack Capital community. Term Sheet Digest is a weekly newsletter for the Attack Capital community. If you are in the mood to read about private company stocks that are heating up in the secondary market and the biggest news around Silicon Valley, you are in the right place. We also tinker with deep

This Week’s Top Pick in Secondary Markets

TLDR;

Databricks punched in $1.4B in revenue in 2022 alongside a 100% CAGR, it raised $1.6B in its last funding round at a $38B valuation, where AWS, GCapital, and Microsoft joined as strategic investors.

Its public market competitor Snowflake was the biggest software IPO - it was expected to open at $120, on the first day of trading, it crossed $300 per share.

With the advancements in AI, Databricks, with its large Data processing prowess, is in a perfect position to catch the tailwind and grow even bigger heights - the reason for its demand in the secondary markets.

Databricks is a Data Lakehouse Architecture company, which now, due to the sign of the times, is a Data Lakehouse Architecture and AI Company. Before Databricks, there was Apache Spark, a data processing framework built in UC Berkeley that can quickly perform processing tasks on very large data sets.

JUST LAY A BRICK

Ali Ghodsi, with his fellow researchers at Berkeley’s AMPLab, realized the complexities of working with Apache Spark and built Databricks, a lakehouse management platform to support Apache to make the process a little easier.

As luck would have it, Apache would become one of the key big data distributed processing frameworks in the world, and with it, Databricks became the biggest data lakehouse architecture platform. In 2022, Databricks punched in $1.4 Billion in revenues and was valued at $38 Billion after clocking in 100% CAGR in the last two years.

THE TIDE TURNS

It has become abundantly clear that 2023 isn’t the year for tech stocks, Databricks’ closest competitor Snowflake was once trading at ~$392 per share - at the peak of the tech bubble- is now trading close to ~$162. But, the massive shift in the stock price doesn’t capture the full story of Snowflake and data warehousing companies. Snowflake, when it went public in 2020, was the biggest software IPO in the history of the world. Snowflake was planning to go public at $120, but on the first day of trading, the stock crossed $300, it was also backed by Warren Buffet’s IPO and tech-averse Berkshire Hathaway.

Databricks was on a similar upward path to Snowflake before the IPO window closed down due to the massive corrections in public and private markets in 2022 and 2023. In 2021 Databricks closed a $1.6 Billion Series H round led by Morgan Stanley, the round also included AWS, CapitalG, and Microsoft as strategic investors. The funding followed the company clocking in $1.4 Billion in revenue and 100% growth in 2022 whilst gearing up for breaking Snowflake’s record of the biggest software IPO. But, the interest rate cuts and inflation fear dampened the mood a little and put all the big plans, parties, and paychecks on hold for a while.

ALL IS NOT LOST

While the tech IPOs and funding rounds are on hold around the globe. Secondary markets are quietly buzzing. Individual investors are looking to get their hands on the stocks of good companies for a discounted price, and Databricks is one of them. Databricks was one of the most traded companies in the secondary marketplace Hiive.

The demand for Databricks is strong in other secondary marketplaces as well. Its secondary market price has suffered a bit from its 2021 peak of $99 due to multiple reasons, (i) dilution and availability due to multiple large funding rounds and (ii) price correction of its public counterpart Snowflake. Databricks itself cut its valuation by 7% in late 2021, and Blackrock, one of its most famed investors, also cut the value of its Databricks holding from ~$20 Million to ~$17 Million, according to Blackrock’s SEC filings. The shares of Databricks are available in the secondary marketplaces for around ~$52 a piece.

DATA IS THE NEW OIL 2.0

It's been a long time since 2006 when the phrase Data is the new oil started making rounds. Today with AI advancing at an unimaginable pace, the phrase holds much more intensity. Databricks, with already a massive head start when it comes to dealing and processing data, is in the perfect spot to catch the AI tailwind - this may be the reason for its massive demand in the secondary markets.

Databricks was already an AI company even before the buzz wordiness of AI took hold of the valley. But, they have made abundantly clear that they are ready to fight and win the AI battleground by releasing a similar but open-source ChatGPT like Chatbot Dolly.

GREEDY WHEN OTHERS ARE FEARFUL

While other big names in the valley are busy downsizing, Databricks is expanding; it renewed its lease recently with an added 10,000 Square feet extra, It is planning to expand its India headcount by 50% and launch a new R&D facility.

The company also appointed country heads in Japan and South Korea and expanded its presence in the countries. This move comes after a similar appointment in India last year, their third biggest market after the US and UK - all pointing towards a renewed focus on the SEA market. The company also started expanding in EMEA and appointed a country manager there as well. Going by the chatter in the valley, the recent moves by the company could be considered as laying the final bricks before an IPO in 2023 or 2024, whenever the tech IPO window opens up.

Top Stories

Flexport acquires Shopify’s Logistics Arm - Flexport is taking over Shopify Logistics – including its San Francisco-based Deliverr platform, acquired last year for $2.1bn, a range of software solutions, and dozens of warehouses and sorting centers.

Swiggy sees its valuation decrease by ~40% - India’s largest food delivery startup Swiggy’s valuation is slashed by Invesco, who lead its last round when its valuation touched $10 Billion. This is the second valuation cut by Invesco, who earlier slashed Swiggy’s valuation from $10B to $8B.

Qualcomm acquires Autotalks for $350M - $400M - Qualcomm acquires Autotalks to boost Snapdragon’s automotive safety technology. Autotalks is a fabless chipmaker out of Israel that builds semiconductor and system-on-a-chip technology to aid in automotive safety.

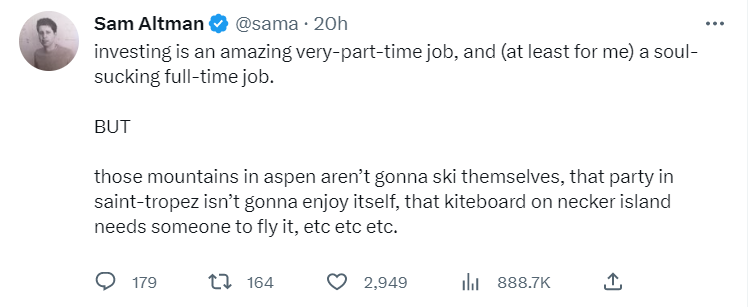

“Thought Leadership”

Link to the tweet because the Substack tweet embed is on hold (Elon Musk).

Last Week in Numbers

40% - Chegg Inc suffered a 40% decrease in its stock price after its CEO Dan Rosensweig in an earnings call, commented that Chat GPT is hurting its growth in new users.

50% - Sound Ventures, a venture firm led by general partner Ashton Kutcher, Guy Oseary, and Effie Epstein, announced that 50% of its AI-focused $240 Million fund is already invested in three companies OpenAI, Anthropic, and Stability. AI.

20% - While Airbnb finished the quarter with $10.6 Billion in cash and investments, it saw a decrease in its growth to 20% from 24% in Q4 2022, signaling a slowdown in travel in the coming months.

Please share this newsletter with your friends, family, and colleagues if you feel that it can benefit them - probably the best compliment we can get :)