YC S23 Has Left The Building

It was YC Demo Day where every single startups got to showcase their product to investors, and there were a lot of stand outs, we take a quick note in our newsletter.

Editor’s Note: Thank you to 47 new people who decided to subscribe to our newsletter, including execs from Datadog, ScaleAI, and Zomato. Term Sheet Digest is a weekly newsletter for the Attack Capital community. If you are in the mood to read about private company stocks that are heating up in the secondary market and the biggest news around Silicon Valley, you are in the right place.

Another batch of Y Combinator has left the building. Congratulations to the Y Combinator Summer 23 Batch.

YC S23 Batch in one line - One of the strongest batches of the last 5-6 years.

The Attack Capital team has thoroughly enjoyed diving deep into the companies of this batch, talking to the founders, looking at their business models, sizing up their ambitions, and finding a couple of great bets for our access fund.

One of the reasons this year’s batch was on another level is because of the higher % of repeat founders starting their 2nd and 3rd companies. There were founders who built more than $100Mn+ businesses in their first stint as entrepreneurs and decided to start from scratch again - we were lucky enough to invest in one of them (Nick Damiano of Andromeda Surgical).

B2B / Enterprise Domination

B2B / Enterprise startups filled almost ~60% of the batch. B2B is said to be one of the “boring spaces” to build a company, but the crop of entrepreneurs managed to make it super interesting by infusing their products with AI.

Bets part about the B2B startups was that a lot of the companies already had contracts with enterprises for their products, and some companies were already at double-digit Millions in revenues. A stark change from companies applying with only an idea.

Market Map of B2B Analytics companies from the current batch. One of the most highly funded categories.

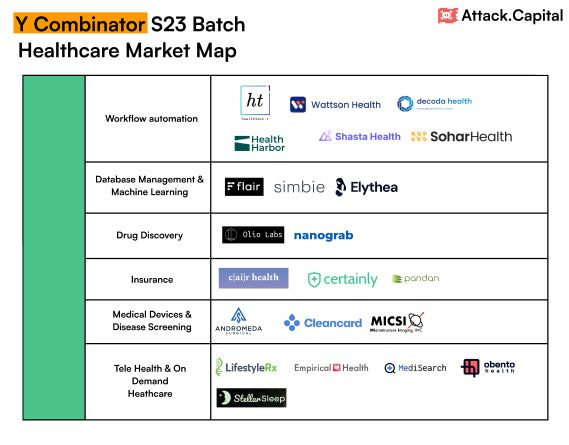

Strong Showing from Healthcare

In the last couple of years, there have been a couple of interesting, bold companies in the healthcare sector, but the number was always small (<10).

This year there were 24 companies building in healthcare, and many of them were started by 2X or 3X healthcare / MedTech founders with more than a decade long experience in the sector.

Market Map of Healthcare Companies.

AI & DevTools Rule the Batch

Y Combinator’s last batch was dominated by AI startups, but at that point in time, AI hype was still in its early days. This time ~70 startups were in the Ai bracket out of the ~240 startups that were in the batch. Even then, then were many startups that didn’t say that they were building an AI company, but an important part of their product was dependent on AI.

DevTools startups this time were 2X or 3X the average number that was seen in the last couple of years. Again AI played a large part here because most startups were building at the intersection of DevTools X AI, and due to the AI hype, a lot of DevTools are being built for developers who want to build AI products & infrastructure.

Here’s our market map of AI startups in the current batch.

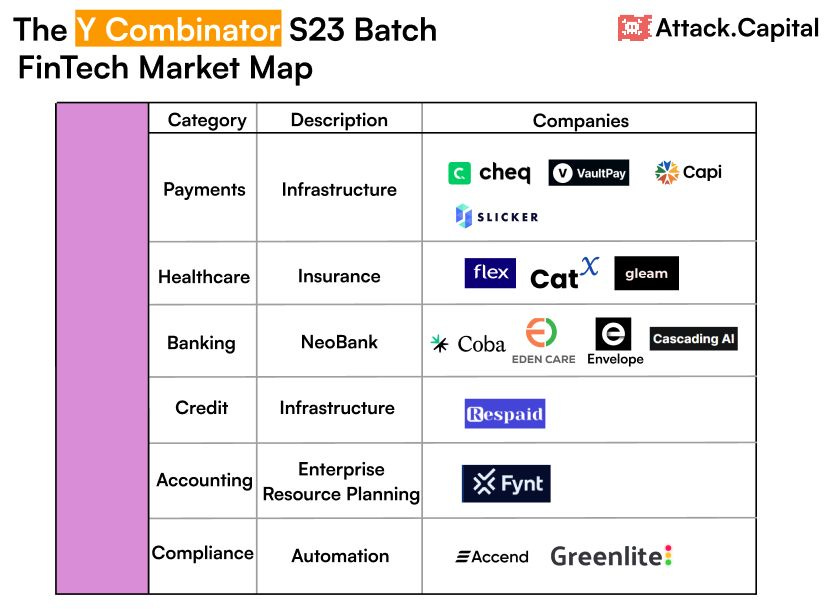

Disappearance of FinTech, South East Asia & LATAM Startups

One trend that stood out was the number of startups in the FinTech sector going down. Fintech used to represent ~40% of the batch, but it quickly went down mostly in this batch. Is it a sign of a slowdown in the sector?

Here’s our FinTech market map.

Startups from important geographies that YC previously loved also disappeared. In the earlier batches, the number of startups from Southeast Asian countries like India and LATAM countries was always going up with each batch. This year there are barely ~10 startups from both regions.

Startups from Europe were a big hit this time ~38 startups in total.

What truly stood out was the quality of each company and founder; just like every investor this year, we were also in awe of every single one of them.

Truly can’t wait to follow their journey over the next couple of years and see what they build.

Please share this newsletter with your friends, family, and colleagues if you feel that it’ll add value to their lives - probably the best compliment we can get :)