Zerodha - The $2Bn Anti-Robinhood Story

Zerodha is a Indian trading platform which ended last year with $250Mn in PAT, for contrast Robinhood reported $830Mn in losses this year. Read about what makes Zerodha so successful.

Editor’s Note: Thank you to 89 new people who decided to subscribe to our newsletter including execs from Charles Schwab, Plaid & Robinhood.

Term Sheet Digest is a weekly newsletter for the Attack Capital community. If you are in the mood to read about private company stocks that are heating up in the secondary market and the biggest news around Silicon Valley, you are in the right place.

Zerodha is India’s largest discount brokerage platform, founded by siblings Nithin and Nikhil Kamath, the company is completely bootstrapped and is profitable from its very first year.

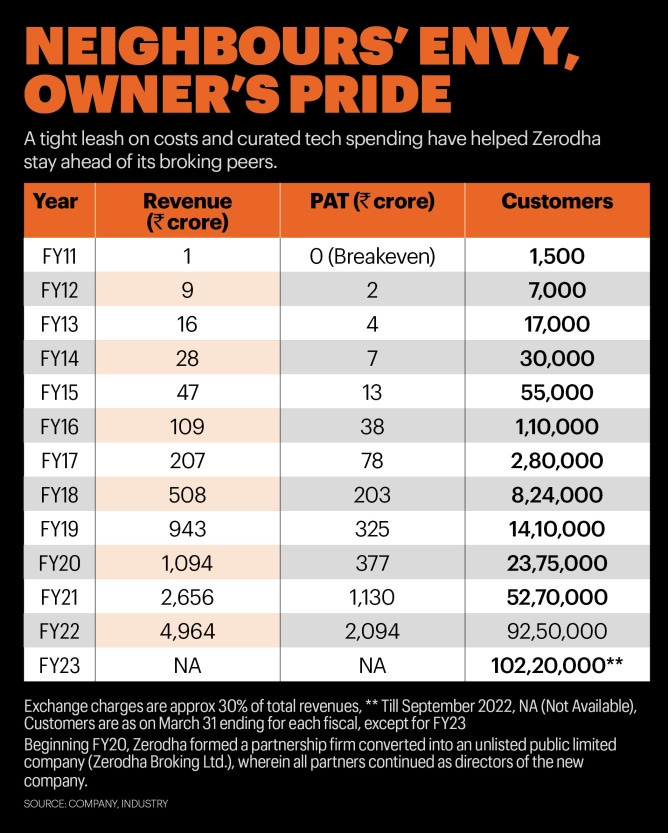

In the financial year 2022, the company recorded 10.2 Million total users, and corners 19.2% of the total market. The company also clocked in $250 Million in PAT on $662.5 Million in revenues.

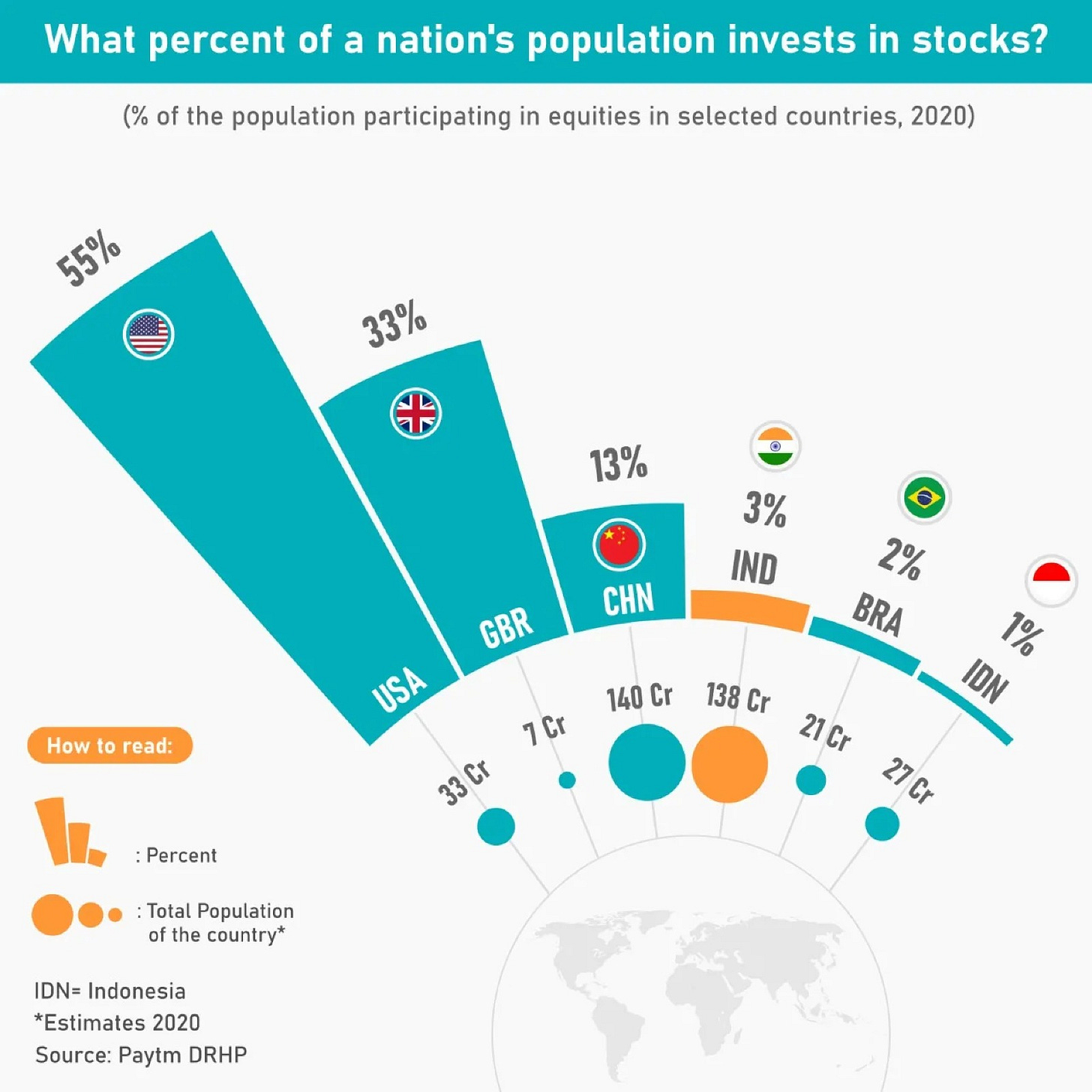

In India only 3% of the population invests in the equity markets, which is abysmally low when compared to China’s 13%, and United State’s 55%. But the growing middle class, and their growing disposable incomes means the number will also rise in the coming years.

Zerodha competes with highly capitalized VC-backed Unicorns like Groww and Upstox, and platforms backed by leading banks but these are yet to pose a clear threat to Zerodha’s dominance and profits.

Zero (Zero) + Rodha (Obstruction)

Nithin Kamath, an out-and-out Bangalore boy, found himself working in a call center at night when he was a teenager. His income from answering phones at night would fund his adventures in the stock markets during the day. In India, barely 3% of the population is active in the equity markets, so a 17-year-old sitting in Bangalore, trading and booking profits, is not an ordinary sight.

Nithin would get his first big shock in the markets in 2001 when the dotcom bubble burst. He ended up losing almost all of his earnings and investments during this phase, but he decided to keep going with whatever money he could salvage. In the next 5-6 years, Nithin would continue trading, he also took on other clients and managed their money and also did a short stint as a sub-broker for Reliance Money.

After more than a decade as a trader, Nithin was tired of the game. His younger brother, who also caught the trading bug, was also on the verge of burning out. Both brothers, having spent a considerable time in trading, complained a lot about terrible trading experience, no transparency, high transaction and brokerage fee. During this period, the seed of the digital revolution in India was also being sown, Flipkart was founded to bring shopping online, and Paytm started to bring transactions online.

After quitting trading, the Kamath brothers started working on a modern digital brokerage platform to introduce transparency and reduce costs in the process of buying and trading stocks. They started Zerodha, a discount brokerage firm, with some of their own savings, the company initially targetted regular traders tired of using glitchy products with high fees. The company was lean, and the product was successful, they broke even in the first year itself.

Don’t Move Fast and Break Things

Although the company was started in Bangalore, the Silicon Valley of India, the preaching of the valley was nowhere near its culture. The Kamath brothers knew the importance of time when it comes to building trust for a company that deals with money. The brothers also kept their realistic brain cells working, they knew in a country like India, it would take time for consumers to fully onboard with the digital revolution, no matter what the VCs and thought leaders say.

Zerodha started by building a superior product, focused on power users, and charged a small account opening fee. In 2010, mostly brokerage and trading products were offered by banks, and banks in India are always the last to adopt new technology, so products weren’t user-friendly or fast they just did the job of minting high transaction and brokerage fees for the banks. There were brokers with brick-and-mortar shops who also executed your orders for you, but for regular traders, it’s not convenient to go to your broker daily to get your orders executed. So, moving the trading experience online and cutting out the additional costs to bring brokerage and transaction fees to abysmally low using technology was enough for Zerodha to win its first set of users. The company brought in $121K in revenue and broke even in the first year with 1500 customers. Instead of spending every single dollar of revenues back into product and marketing, the company let itself grow with the market.

The New Trading Class

In most countries, earlier, the people who regularly traded in the markets were on the older side of the age bracket - people who have started making comfortable amounts of money and are willing to play with a little bit of it by investing in the markets. In India also, the same pattern emerged early on, but in the early 2010s, the Indian middle class under the age of 35 was growing quickly, and their salaries grew faster. With the help of the internet, young people also shunned the age-old beliefs of investing in fixed Deposits and Gold and turned to the stock market.

The number of first-time traders grew, and with them, Zerodha turned their focus towards them, these are not the people who would go to a brick and mortar brokers or deal with the glitchy products offered by Indian banks, they preferred apps, and Zerodha was their first choice. In 2015, Zerodha crossed 100K active users on its platform, the company closed the year with $13.2 Million in revenues and $4.6 Million in profits.

Tough Competition

Zerodha introduced an entire stock broking industry to discount brokerage, the market was growing albeit slowly, but it was growing, and the incumbents also found it hard to innovate quickly, so it is highly likely that new competition would through their hats in the ring.

One of the competitions is Groww, started in 2016 by former Flipkart execs. The company focused on building its capabilities for the first 2 years, and it was accepted into Y Combinator’s batch in 2018. Since its YC acceptance, the company has raised rounds after round of funding, many of which are led by YC and its continuity fund. In October 2021, the company raised $251 million as part of its Series E round led by IconiQ Growth and other investors, including Tiger Global, almost tripling its valuation to $3 billion in a little over six months. But, the business performance is not at par with its performance in the fundraising roadshow. Groww’s platform offers stocks, mutual funds, and other ETFs to its investors. Though Next Billion (stock trading platform) clocked revenues of ₹40 crores ($4.8Mn) in FY21 and turned profitable with ₹2.73 crores (300K), the parent entity, Billionbrains Garage Ventures, posted losses of ₹107($13Mn) crores on consolidated revenue of ₹52 crores (6.3Mn).

Upstox is putting stiff competition using the enormous amount of money it managed to raise in recent years. The company claims to have crossed 10 million customers in June. The Mumbai-based company became a Unicorn last November when it raised $25 million in a Series C round led by Tiger Global at a valuation of $3.5 billion. While financials for FY22 are not available, a five-time jump in business promotion expenses to ₹113 crores ($13.7 Mn) saw losses widen 89% to ₹72 crores ($8.7 Mn) even as revenue nearly tripled to ₹429 crores ($52 Mn) in FY21. One of the high costs was advertising and marketing as the firm tied for cricketing events with the ICC, BCCI, and Tamil Nadu Premier League.

Most of the new venture-backed competitions have done one thing right: expanding the share of new users by marketing and educating them about the equity markets. But, the level of trust in Zerodha is so deep that most of the first-time users prefer to open their accounts on Zerodha, even though you have to pay a small account opening fee, while other venture-backed players open your account for free. It is yet to be seen what app becomes the staple as the number of people trading in the markets increases exponentially, but it is clear that in the last decade, Zerodha has emerged as a clear winner. The competition is stiff, and Zerodha also realized the need to upgrade even though it doesn’t have the backing of a multi-billion dollar VC firm, it has a huge profit pool from which it can easily invest in its product offerings, and that’s what happened in the last two years.

Zerodha instead of marketing directly relied on the it's referral program, and using their power users to bring their trading friends along. Other VC-backed companies relied on cash back offers, while Zerodha offered 10% of the brokerage of new user to the person who referred. Using this method Zerodha focused on active users instead of just total number of users unlike other VC backed companies which were more focused on topline numbers so they could raise their next round fast.

The Zerodha Ecosystem

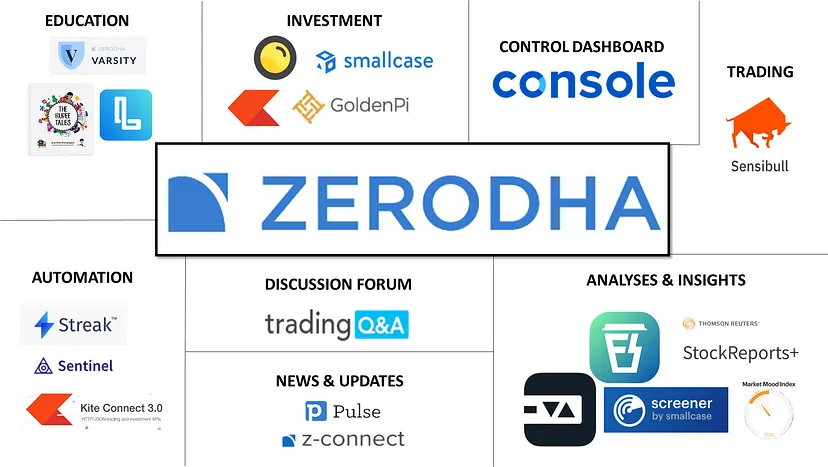

As the offering and competition from Venture-backed companies started heating up, Zerodha stuck to its strategy of building better products by keeping its users' interests in mind and launched a full ecosystem of its products, and provided some of its technology to third parties. Below is a brief on what each of Zerodha’s core products provides:

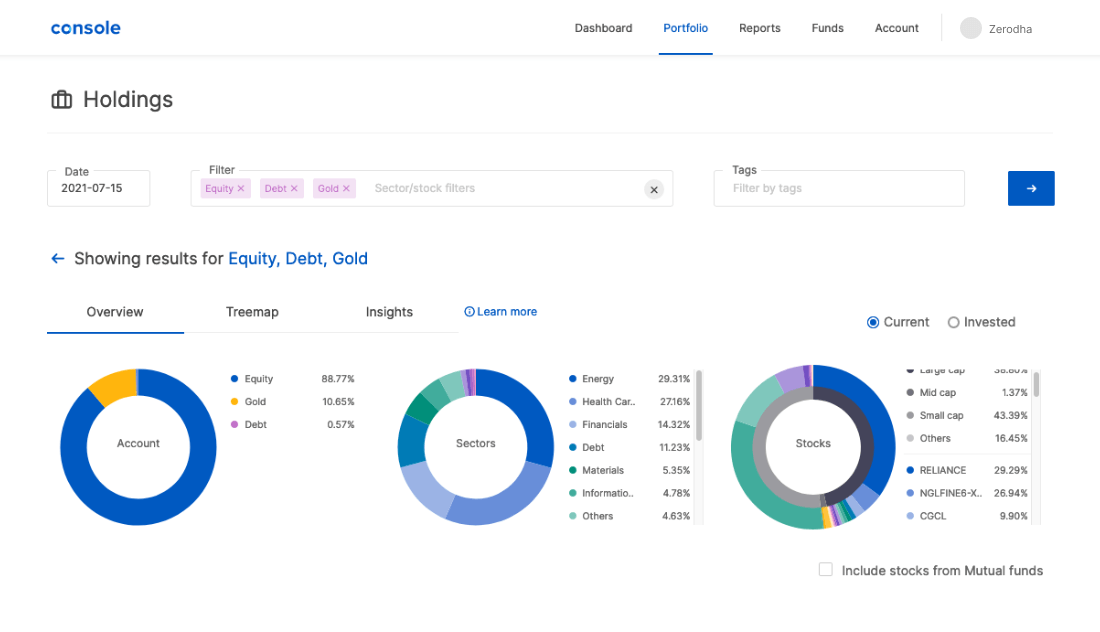

Console: A central dashboard of a customer’s account with Zerodha will provide in-depth reports and visualizations to get more insightful ideas.

Kite is a sleek trading and investment platform using the latest technologies. It eases the customer’s experience of trading and transacting in the stock market.

Kite Connect API: This is mainly focused on independent traders and startups to enable them to build an innovative trading and investment platform. Using algorithms, retail traders can automate their trades.

Sentinel: A platform that enables you to create market alerts. The alerts can be customized based on price, trade quantity, and open interest. The interesting aspect of this product is that you do not need to be a Zerodha customer in order to use Sentinel.

Z Connect: This is a blog facility regarding stocks, trading, and investment with Zerodha. They publish articles and information on this blog, and any user is allowed to ask questions and post comments.

Varsity: One of the challenges faced by this firm was that it lacked in providing research services to its customers, who are sometimes clueless about what and when to buy or sell. To overcome this, they come up with Varsity, which gives a vast collection of stock market lessons on the go.

Coin: It provides a commission-free purchase of mutual funds directly delivered to the customer’s Demat account.

Rainmatter: It is an incubator that provides funding as well as mentorship to startup companies in capital markets and gives a minority stake in the exchange.

The Anti-Robinhood Story

In the US, Robinhood was out to become the kingpin of the trading app. But Robinhood was started in a market where people were already using other platforms - 55% of the people to go by the numbers. So, the company found itself competing and spending a lot of money to target and convert users - Robinhood spent $325 Million in FY21 in marketing costs. The company has 22.9Mn users and 12.9 MAU.

Zerodha found itself in a completely untouched market, with almost no competition in the beginning. The company made a sensible decision to grow profitably with the market instead of spending unnecessarily to chase vanity metrics like the number of total users. They knew that even though they could grow their total users by spending heavily, it will only increase their spending on technology to accommodate those users, and they won’t make money unless they traded regularly. In 2021, when the markets were at their peak, Zerodha clocked in 10 Mn total users and registered ~$250Mn in net profits. The best part is India still hasn’t crossed the 5% mark when it comes to the population active in the markets. One can only imagine the size of Indian markets when it reaches China’s 13% and the United States 55%, Zerodha has also firmly placed itself at the center of this growth and can expect only good things in the next decade.

Top Stories

Elon Musk has launched an artificial intelligence startup that will take on OpenAI and be “pro-humanity,” as he said the world needed to worry about the prospect of a “terminator future” in order to avoid the most apocalyptic AI scenarios.

Flexport’s Ryan Petersen joins venture firm Founders Fund as a partner, read all about Ryan Peterson’s Flexport journey in our previous piece here.

Twitter clone Meta’s Threads crossed 100 million-plus users in just a matter of days, the app took just 7 hours to cross the 10Mn mark when it was launched last week.

Organized criminals exploited a flaw in Revolut’s payment systems to steal more than $20 million of the fintech’s money.

Great read!